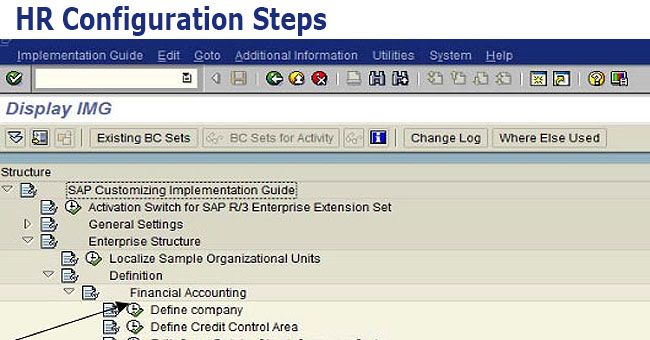

Thus, we use it to categorize assets into categories. SPRO => Financial Accounting (New) => Asset Accounting => Organization Structure => Asset Classes => Create Screen Layout Rule Asset ClassĪn asset class is a classification parameter. It controls the field settings of Asset Master Data. SPRO => Financial Accounting (New) => Asset Accounting => Organization Structure => Asset Classes => Specify Account Determination Create a Screen Layout Rule We represent it with asset sub-numbers.Īccount Determination in Asset Accounting in SAP FICOĪccount Determination in asset accounting creates a link between the asset classes and the GL accounts. Simple Asset: A simple asset is represented by the main asset number and does not have any sub-asset.Ĭomplex Asset: While a complex asset is denoted by the main asset number that contains one or more sub-asset. The Fixed Asset Accounting in SAP has two types of Structure.Ī fixed asset can be a simple asset or a complex asset. You may be interested in: Ledgers in SAP S/4HANA Finance Structure of Fixed Asset To change or denote a depreciation area as real or derived, copy the entry and select or deselect the Real checkbox. SPRO => Financial Accounting (New) => Asset Accounting => Organization Structure => Copy Reference Chart of Depreciation/Depreciation Areas Transaction Code- EC08įurther, you may also maintain a target ledger group ( Leading or Non-Leading) to which a particular depreciation area should post. Post the Acquisition and production cost (APC) and depreciation on a periodic basis and so on.Select the appropriate value in the G/L field to determine how the values from this area including depreciation are to be posted to G/L. (Or Copy Reference Chart of Depreciation) Instead, you should use them as the reference chart of Depreciation to create your own chart of depreciation. This is for countries like the USA, Germany, UK etc. SAP provides a number of the country-specific standard cost of depreciation. In that case, you use a separate country-specific chart of depreciation. However, it differs when you have company codes in different countries with varying legal and statutory requirements. Else operate in different countries but with the same rules of asset valuation.Or operate in different countries but in the same industry.This is when you see one of the following characteristics:

Importantly, several company codes can work with the same chart of depreciation.Īlso, you require only one chart of depreciation in SAP FICO Asset Accounting for all your company codes. This we do together with country-specific rules for asset valuation. Organization Structure – Chart of DepreciationĪ chart of depreciation is a list of depreciation areas that we arrange according to the business and legal requirements of a country.

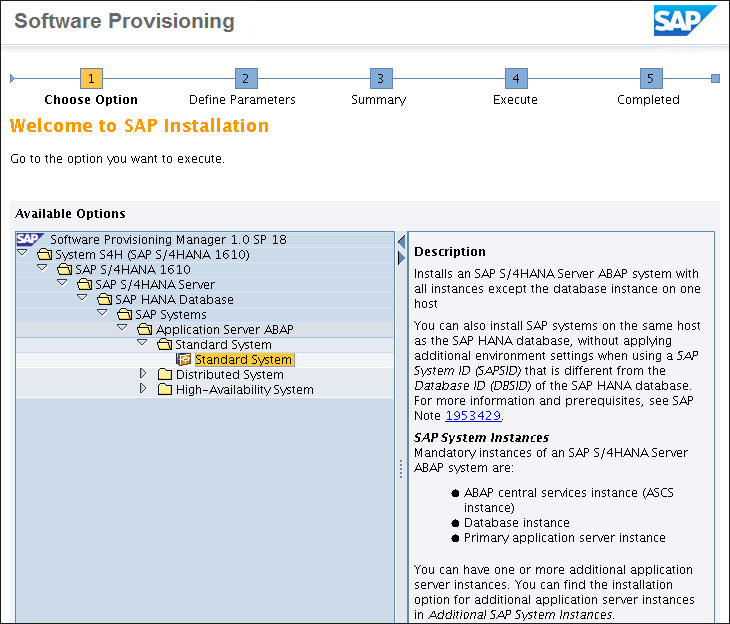

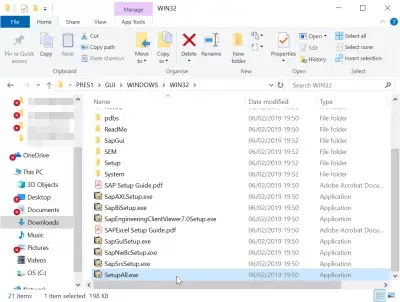

Sap installation guide step by step pdf how to#

Watch YouTube Video:- Learn How to Configure Asset Accounting in SAP FICO You must learn these Asset Accounting settings and configurations practically in order to properly set up the Asset Accounting into the SAP system.

0 kommentar(er)

0 kommentar(er)